capital gains tax increase uk

Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed - as of the Budget on 27 October 2021 - this was immediately increased to 60 days. Try the UKs fastest and most trusted digital tax advice service.

Capital Gains Tax What Is It When Do You Pay It

Add this to your taxable income.

. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still. The OTS made a recommendation to scale back the capital gains tax exemption to below 5000 which would bring more taxpayers into the Capital Gains Tax net tax growth on wealth and increase tax take. That being said whether you are taxed at 20 15 or 0 will depend on what your taxable income is.

The rates for higher rate taxpayers are 20 and 28 respectively. Some 323000 taxpayers footed the CGT bill in 2020-21 an increase of 53000 from the previous year. Connect With a Fidelity Advisor Today.

One of the areas the government is looking to increase its tax collection from is capital gains. This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains accruing on the disposal of residential property that do. This allowance is the amount before any tax is payable.

Book a call today. The Capital Gains tax-free allowance is. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it.

This would bring the capital gains tax rates to the levels comparable to the early 2000s when it was last equalised with income tax. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019-20.

Rishi Sunak has been encouraged to increase the percentage paid on Capital Gains Tax or tighten the rules around it in the Autumn Budget 2021 according to reports. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as the top slice of income. If you pay the basic rate of capital gains tax your bill depends on the size of your gain your taxable income and whether your gain is from residential property or other assets.

The UKs Capital Gains Tax take was up 42 to 143 billion in 2020-21 from 101 billion in 2019-20. 12300 6150 for trusts You can see tax-free allowances for previous years. Individuals have a personal allowance of 12300 a year meaning that no capital gains tax is payable on gains of less than this amount.

Ad Make Tax-Smart Investing Part of Your Tax Planning. If youre self-employed under a limited company you pay yourself the 12300 tax free salary and then the. Read more in this article by Kroll Restructuring experts.

Because the combined amount of 20300 is less than 37700 the basic rate. It is unlikely to be a controversial reform to the majority of the UK population given that an increase in CGT is only estimated to impact a small percentage of the. On top of that CGT on residential property disposals accounted for 17bn in 2021-22 and was a bill picked up by 129000 taxpayers.

Under the current system income which covers earnings such as salaries is taxed at a maximum rate of 45. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. As a higher rate.

How much is Capital Gains Tax. In line with the increase in the main rate the UK Diverted Profits Tax rate will also rise to 31 from April 2023. The main exemption is the Principal Private Residence relief on the sale of.

The following Capital Gains Tax rates apply. Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time. Taxes united-kingdom capital-gains-tax capital-gain Share Improve this question.

Or could the tax rate be retroactively applied to the 202122 tax year. You may also be able to reduce your tax bill by deducting losses or claiming. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

UK Autumn Budget 2021 rise CGT rates on property and 2022 allowance explained. Capital gains the profit made when an asset such as shares or property is sold for. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more.

The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0 to 20. Trustees have half the personal allowance so currently 6150. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals for residential. Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property. Currently there are four rates of CGT being 18 and 28 on UK residential property and 10 and 20 on all other assets the rates depending on whether the taxpayer pays basic or higher rates of tax.

Any capital gains exceeding this amount will be subject to US tax.

What Are Capital Gains Tax Rates In Uk Taxscouts

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

One Of The Questions We Get Asked Most Knowing What Expenses Are Allowable Against Rental Income By Hmrc Is Essential Fo Rental Income Being A Landlord Income

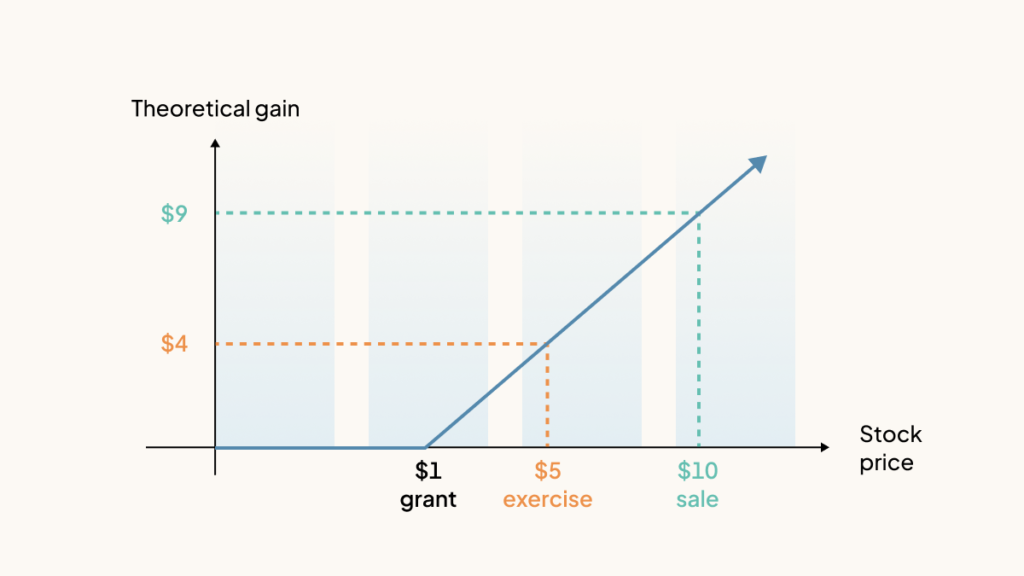

How Stock Options Are Taxed Carta

Canada Capital Gains Tax Calculator 2022

Capital Gains Tax What Is It When Do You Pay It

How High Are Capital Gains Taxes In Your State Tax Foundation

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Crypto Tax Uk Ultimate Guide 2022 Koinly

Capital Gains Tax Cgt Calculator For Australian Investors

Get Ready For 178 Billion Of Selling Ahead Of The Capital Gains Tax Hike These Are The Stocks Most At Risk Marketwatch Capital Gains Tax Capital Gain Tax

Pin On Uk Property And Real Estate

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting